The intelligence behind intelligent decisions

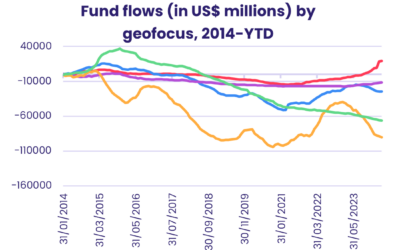

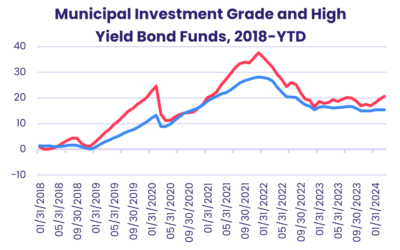

Unparalleled understanding of how money is moving and why

EPFR provides a deeper view of the market to show where money is moving across geographies, sectors, industries and securities, enabling the global investment community to make intelligent decisions based on solid facts.

Our best-in-class Fund Flows and Allocations Data helps you reveal the investible truth by looking at market trends, investor sentiment, liquidity, risk signals and corporate actions, and can be tailored to your specific use case.

$54T+

93%

151K+

$7T+

25+

Primary benefits

Industry-leading timeliness and granularity

Supports both bottom-up and top-down asset allocation strategies

Illustrated analysis of key factors driving current flow trends

Critical insights at macro and stock levels

Unique views on fund manager and investor sentiment

Insight into the fixed Income fund market at a bond ownership and security level

Personalized,

consultative approach

Data tailored for your unique strategy

Our experts work with you 1-on-1 to assess your use case and ensure that you are getting the best inputs and most actionable insights for your needs.

EPFR is a global company built on service and helping the investment community gain a deeper understanding of what’s really happening.

Trusted by:

%

of the Bulge Bracket (the world’s largest investment banks)

%

of the “top 20” global asset management firms (by AUM)

%

of the Bulge Bracket (the world’s largest central banks)

%

of the “top 20” global asset mgmt firms (by AUM)

Latest Insights

Thought leadership and analysis that help you find a signal in the noise

The cruelest month shows its colors

April is known for its showers, warming trends and sudden changes in climate. This April, it has been missiles and attack drones that made up the showers, prices that have stayed warm and the investment climate that has shifted abruptly.

1Q24 Recap Webinar

EPFR’s CIO, Sayad Baronyan, and Research Director, Cameron Brandt, will dig into the data from 1Q24 and highlight areas that will play a role in shaping the market narrative during the second quarter.

Investors feel the squeeze in early April

There were some unwelcome additions to the “higher for longer” list during the first week of April as geopolitical risks and energy prices joined US interest rates on the tally sheet. Fears that Iran will become directly involved in Israel’s war with Hamas in Gaza and Ukraine’s drone campaign against Russian refineries pushed oil prices towards a six-month high.

The cruelest month shows its colors

April is known for its showers, warming trends and sudden changes in climate. This April, it has been missiles and attack drones that made up the showers, prices that have stayed warm and the investment climate that has shifted abruptly.

1Q24 Recap Webinar

EPFR’s CIO, Sayad Baronyan, and Research Director, Cameron Brandt, will dig into the data from 1Q24 and highlight areas that will play a role in shaping the market narrative during the second quarter.

Investors feel the squeeze in early April

There were some unwelcome additions to the “higher for longer” list during the first week of April as geopolitical risks and energy prices joined US interest rates on the tally sheet. Fears that Iran will become directly involved in Israel’s war with Hamas in Gaza and Ukraine’s drone campaign against Russian refineries pushed oil prices towards a six-month high.

Market Insights: GEM Ex-China

Join us for our 20-min Market Insight call on GEM Ex-China, hosted by EPFR’s Research team; Cameron Brandt, Steven X. Shen, CQF and Kirsten Longbottom.